Healthcare’s Biggest Trends in 2023: Industry Forecast from Redesign Health

Powering healthcare innovation at scale is the heart of our work at Redesign Health. With 2023 on the horizon, we surveyed our cross-functional team of industry leaders for their take on what’s needed, what’s possible and what healthcare companies should expect in the year ahead. Here’s their forecast for 2023’s biggest trends in healthcare.

1. Labor shortages will persist

Large numbers of our most experienced healthcare professionals are set to quit or retire in the next few years, with the Bureau of Labor Statistics estimating that 500,000 nurses left the profession in 2022 alone. The pandemic has driven burnout and stress that has exacerbated the labor shortage in healthcare, and the American Hospital Association has deemed the situation a national emergency, with a shortage of 1.1 million nurses heading into 2023 and a shortfall of 3.2 million allied health professionals over the next five years.

Venture Chair Karthik Krishnan sees "attracting early career professionals to healthcare, and retaining them through active financial and career progressions” as key to achieving the trifecta of access, cost and quality goals.

Meanwhile, Beverly Grossman, VP of Government Affairs, notes that though “we are coming out of the pandemic with an overstressed workforce and not enough patient-focused healthcare workers. Employees have gained strength in this economy, and like management groups, they are looking to policymakers to help ease this pain.” She sees the labor shortage as a priority item for federal, state and local policymakers in the coming year.

2. Innovation moves from the front of the house to the back

Each year pushes healthcare modernization forward, but 2023 may be the year healthcare leaders refocus on administration upgrades. While largely out of view of consumers, these enhancements will drive efficiencies and ultimately improve profitability for healthcare systems.

Rona Li, Managing Director, explains: “Administration spending contributes around $1 trillion in healthcare spending, with the bulk hiding in financial and corporate functions of payers, pharma and health systems that only those from within can truly understand. Expect partnerships between incumbents and innovators to continue to address these pain points.”

Venture Chair Missy Krasner echoes the rise of the “unsexy business” in powering healthcare workstreams and offering investing opportunities. “Incumbents, such as payers and providers, will embrace administrative software solutions, while infrastructure as a service brings new innovation to billing, RCM, eligibility, scheduling and member engagement.”

3. Refinement and scaling of hybrid care models

Hybrid care models will continue to change the game for patients and providers looking for more flexibility in reaching diverse populations across the healthcare continuum.

“The majority of value-based savings opportunities fall into high-cost specialty care, like cardiology, orthopedics, oncology and behavioral health,” shares Mark Rosenblum, Managing Director of New Ventures. “To date, these areas have lacked the scale and ability to measure required for at-risk pricing agreements.”

Venture Chair Danielle Russella thinks retail clinics will double their share of the primary care market. “Players like Amazon, Optum, Walmart and Walgreens have the money to invest in this lucrative space and are likely to offer better experiences and price than traditional health systems.”

Eric Morris, Managing Director, thinks we’ll shift from prevention as a cost-reduction measure toward high-cost chronic disease management. “As technology becomes ubiquitous and easier to develop, clinical efficacy will take center stage, and care models and clinical results will become moats.”

4. Increased accessibility for those who need it most

If there was a silver lining to the pandemic, it was opening the door to virtual care solutions, something experts predict will extend into 2023. While the industry has made progress in this area, it still has a long way to go.

“Despite all the advances in medicine and new innovations,” Alicia Bloom, Vice President, says, “individuals and families still struggle to access the care they need, whether for wellness and prevention or chronic disease management. Access issues could be related to coverage and affordability, geographic location, and long wait times due to workforce shortages, to name a few.”

Virtual solutions, telemedicine and community-based care hold the key to serving those populations. Grossman, Bloom and Neil Patel, Head of New Ventures, all cited the temporary telehealth expansion granted during the COVID-19 health emergency as a much-needed tool for providing accessible care.

Drug costs are likely to also come down, with Head of New Business Development Kyle Tatz predicting that “2023 will be the year that payers and government entities finally make headway in reducing drug pricing for high-cost solutions and insulin.”

5. Recalculating the cost of care

What benchmarks will we use to measure both health and financial gains? The coming year may be a gamechanger for even the most widely accepted policies.

We could see what Advisor Scott Disch describes as a move from “episodic cost measurement to longitudinal chronic disease management.” While the past decade has prioritized quality measures, risk adjustment, post-acute transitions, patient engagement and keeping people out of the ER, this won’t be the way to manage Medical Loss Ratio (MLR).

Disch anticipates utilization, decision support and “next-generation care management” may change the tide for payers and financiers. He notes, “Investors are expecting a waterfall effect on MLR and for new companies to get paid on milestone achievement or results, and no more advance Per Member Per Month Payments (PMPM) with a future promise of cost improvement.”

6. Stitching, not just consolidating, the healthcare tapestry

For both small and large healthcare systems that survived the turmoil of the past few years, more change is looming. While health systems have relied heavily on investment income and access to cheap capital to grow despite razor-thin margins, the market downturn and labor costs may force additional mergers and acquisitions.

The result? “Physicians who sold their practices to health systems will leave and/or buy their practices back as they see greater opportunities to thrive in independent practice,” Patel explains. “They could capture a greater share of the value they generate via risk-based arrangements with payers."

Meanwhile, Rona Li notes, “Over the past few years, innovation in payment models and delivery modalities has opened up the ability to address more needs than ever before. However, as stakeholders have become inundated with options, there is the need not only to consolidate, but to ‘stitch’ solutions into the existing infrastructure.” This could include greater collaboration with family caregivers and virtual third-party staff to coordinate care and eliminate redundancies; helping patients choose the right care and patch together services; and leveraging data to better serve patients at every stage of their journey.

New innovations for not-so-new challenges

With the high cost of supplies and the shrinking labor market, health systems that were feeling the pinch before may now find themselves on the brink without sustainable, forward-thinking change. From better back-end systems to harnessing data, tech is one way leaders see positive changes coming. Leaders will continue to refine equity and sustainability efforts, creating best practices in real time.

We're optimistic for what 2023 will bring as we continue to develop technologies, tools, and insights that lower the barriers to change across the industry.

![No alternate text]() Redesign HealthDemystifying Healthcare Innovation: 4 Lessons on Driving Meaningful Change

Redesign HealthDemystifying Healthcare Innovation: 4 Lessons on Driving Meaningful ChangeInnovation is a frequently used buzzword in healthcare. Despite its widespread usage within our industry, achieving tangible value and impactful outcomes often proves challenging.

April 16, 2024

![No alternate text]() Healthcare TrendsRedesign Health2024 Health Trends: 4 Experts Discuss Key Innovation Priorities

Healthcare TrendsRedesign Health2024 Health Trends: 4 Experts Discuss Key Innovation PrioritiesTo uncover the most pressing healthcare issues—and possible solutions—on the horizon for 2024, our team polled four influential industry thought leaders and Executive Advisory Board members at Redesign Health.

January 10, 2024

![No alternate text]() MedicaidModernizing Medicaid with a Multi-Stakeholder Financing Model

MedicaidModernizing Medicaid with a Multi-Stakeholder Financing ModelDiscover how a multi-stakeholder financing model could overcome some of Medicaid’s obstacles, dramatically improving health and quality of life outcomes for Medicaid recipients while generating savings across government programs.

November 15, 2023

![No alternate text]() Chronic CareRedesign HealthWraparound Care: The Next Frontier in Chronic Care Management

Chronic CareRedesign HealthWraparound Care: The Next Frontier in Chronic Care ManagementExploring tech-infused strategies to manage chronic conditions

September 05, 2023

![No alternate text]() ADVISORSRedesign HealthRedesign Health Advise: Leveraging Experts and Insights to Expand Impact

ADVISORSRedesign HealthRedesign Health Advise: Leveraging Experts and Insights to Expand ImpactThe Redesign Health Advise program connects our team and founders with a deep bench of experts from across the healthcare industry.

June 29, 2023

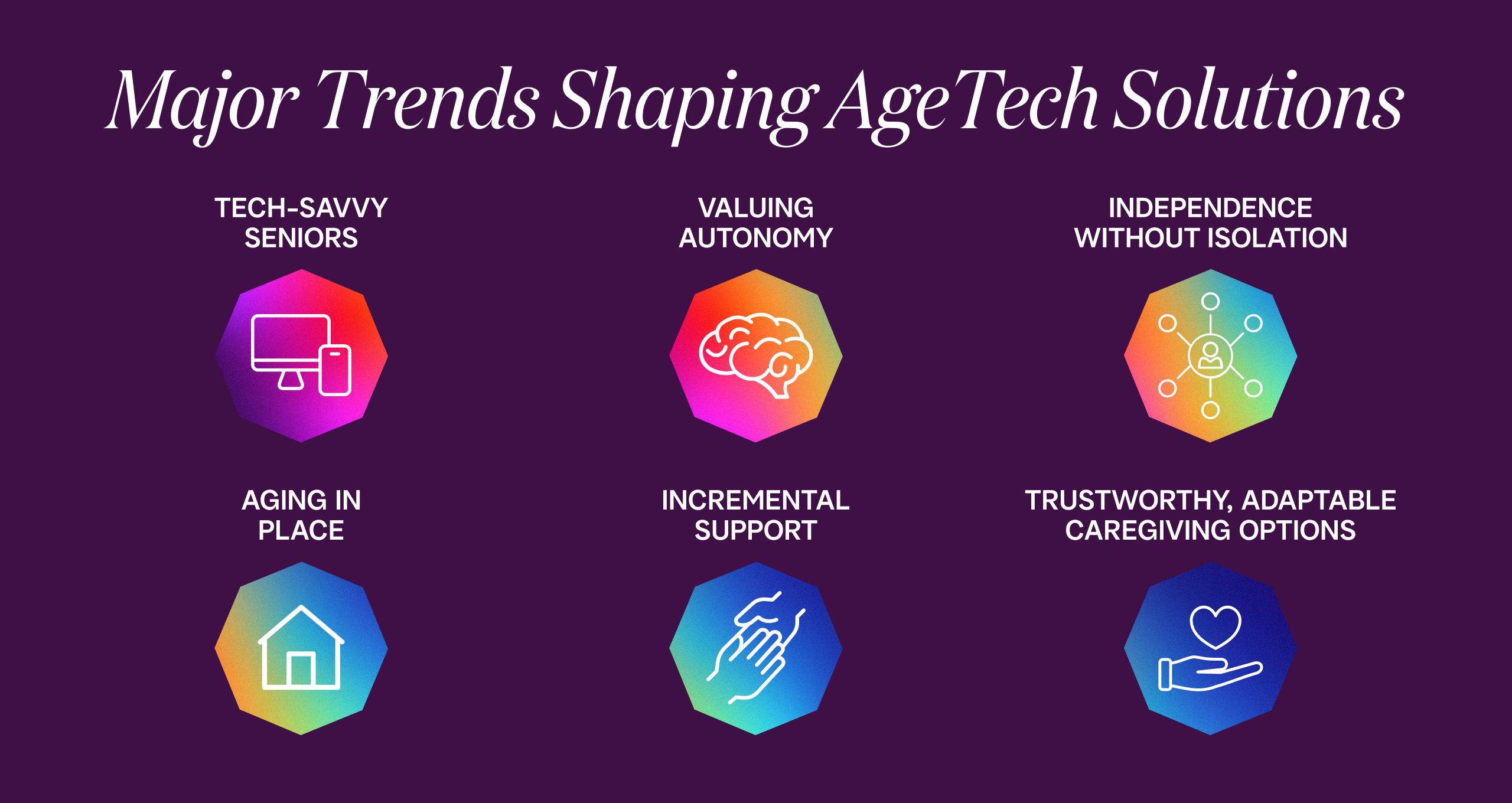

![No alternate text]() Senior HealthRedesign HealthInvesting in AgeTech: Serving the Growing Senior Health Market

Senior HealthRedesign HealthInvesting in AgeTech: Serving the Growing Senior Health MarketProviding targeted tech solutions for aging adults

June 14, 2023

![No alternate text]() Shifting Sites of Patient Care: Driving Value in Alternative Settings

Shifting Sites of Patient Care: Driving Value in Alternative SettingsRight care, right setting: Unlocking value in alternative sites of care

April 27, 2023

![No alternate text]() Value-Based CareThe Evolution of Value-Based Care: Exploring Challenges and Opportunities in Adoption

Value-Based CareThe Evolution of Value-Based Care: Exploring Challenges and Opportunities in AdoptionRedesign Health Venture Chair Missy Krasner recently hosted a roundtable discussion with leaders in the Value-Based Care Industry to explore how the adoption of value-based care is unfolding--and what to expect in the coming years.

February 15, 2023

![No alternate text]() James QuarlesThe Kids Aren’t Alright: Addressing the Adolescent Mental Health Crisis With Accessible, High Quality, Evidence-Based Practice

James QuarlesThe Kids Aren’t Alright: Addressing the Adolescent Mental Health Crisis With Accessible, High Quality, Evidence-Based PracticeResearch shows that mental health disorders have surpassed physical conditions as the most common causes of impairments and limitations in children. Suicide was the second-leading cause of death among 10 to 14 year-olds in 2020.

February 15, 2023

![No alternate text]() PartnershipsRedesign HealthPartnering with Leading Health Systems to Drive Change and Improve Outcomes

PartnershipsRedesign HealthPartnering with Leading Health Systems to Drive Change and Improve OutcomesAt Redesign Health, we firmly believe the US healthcare system desperately needs innovation to address our lagging health outcomes, sky-high costs and uneven access to care.

February 09, 2023

![No alternate text]() Platform, Company CreationBehind the Curtain: Redesign Health's Company Creation Process

Platform, Company CreationBehind the Curtain: Redesign Health's Company Creation ProcessIt's easy to say healthcare is broken. It's much harder to fix it. At Redesign Health, we’re up for the challenge.

February 01, 2023

![No alternate text]() Healthcare TrendsHealthcare’s Biggest Trends in 2023: Industry Forecast from Redesign Health

Healthcare TrendsHealthcare’s Biggest Trends in 2023: Industry Forecast from Redesign HealthPowering healthcare innovation at scale is the heart of our work at Redesign Health. With 2023 on the horizon, we surveyed our cross-functional team of industry leaders for their forecast for 2023’s biggest trends in healthcare.

December 15, 2022

![No alternate text]() Insights from the Redesign Health Ecosystem: Improving Healthcare for Older Adults

Insights from the Redesign Health Ecosystem: Improving Healthcare for Older AdultsRedesign Health Venture Chair Missy Krasner recently hosted a roundtable discussion with leaders from three of our Operating Companies to explore the state of older adult healthcare in the U.S. and how their teams are facilitating healthier aging.

October 21, 2022

![No alternate text]() ResearchRedesign HealthStuck in the Middle: Healthcare Solutions for Older Adults Shouldn’t Be One Size Fits All. Here's Why.

ResearchRedesign HealthStuck in the Middle: Healthcare Solutions for Older Adults Shouldn’t Be One Size Fits All. Here's Why.There will be more older adults than children in America by 2035. We are not ready. A one-size-fits-all approach to older adult healthcare simply won’t be able to comprehensively support the needs of so many aging people.

October 05, 2022

![No alternate text]() Company CultureRedesigning Company Culture

Company CultureRedesigning Company CultureWe have big ambitions at Redesign Health: to make humanity healthier and to redesign healthcare for everyone. We strive to do things differently here, and building our company culture is no exception.

July 18, 2022