Modernizing Medicaid with a Multi-Stakeholder Financing Model

By Phil Poley, Venture Architect at Redesign Health

When President Lyndon B. Johnson urged Congress to create Medicaid and Medicare nearly six decades ago, he established a North Star that still inspires: “We can – and we must – strive now to assure the availability of and accessibility to the best health care for all Americans, regardless of age or geography or economic status,” he said.

Those of us who’ve worked in Medicaid remain committed to this ideal. That commitment comes from a passion for the mission, the inspiration of seeing how Medicaid transforms lives, and the firm belief that Medicaid can have an even greater impact if we address some of the obstacles to its success. This belief is grounded in the evidence, which shows overwhelmingly that Medicaid has a positive impact on clinical outcomes, health disparities, economic mobility, and provider and state finances.

Many who have worked in Medicaid agree and see its numerous positive benefits. “I’ve repeatedly met and often worked with hundreds of individuals whose early family lives were supported with access to healthcare through Medicaid,” says Greg Buchert, a Redesign Health Advisor and healthcare consultant with more than 20 years experience serving as an executive in some of California’s leading Medicaid plans, including CalOptima, Centene Corporation/Health Net and California Blue Shield. “This allowed children to be healthy enough to attend school, parents to work (often in jobs that benefit all members of society), and grandparents to live long enough to share history, culture and love of family.”

Strengthening Medicaid with alternative financing models

Given this evidence, what’s holding us back from achieving Medicaid’s true potential? Spoiler alert: it’s a financing model that is not aligned to current realities.

Let’s start with the quote from LBJ. It’s from 1965. That’s when Medicaid was first enacted, and the foundational legislation has never been revised. Think about that for a minute: this legislation pre-dates the moon landing, cable TV, managed care, cellphones, the Internet and AI.

In 1965, Medicaid covered 4 million people, far fewer than the approximately 90 million individuals covered today. Today’s Medicaid coverage includes more than 40% of all births in the US, nearly half of children with special care needs, and five in eight nursing home residents. This growth is due in part to state and federal policymakers’ commitment to innovation. Medicaid programs now operate via a complex set of waivers that stay true to the letter of the initial law while enabling new approaches that strive to meet the vision.

But there are limits to waivers that continue to prevent Medicaid from achieving its full potential. The current focus on social determinants of health (SDoH) does a great job of making the case for a new financing model.

Yasmine Winkler, a Redesign Health Advisor and former CEO for UnitedHealthcare’s Medicaid plans in the Central Region, explains: “When I ran Medicaid health plans, we learned from direct experience that addressing a person’s whole health is critical. That led us to make investments outside the typical province of payers—we started a transportation company and built affordable housing.

"Sustained emphasis on innovation from Medicaid programs continued to push us in this direction. But there are limits to how far we can afford to innovate within the current financial structure, and bringing more stakeholders into the financial and data exchange equation would add to the momentum and help us realize the full value of whole-person care.”

Making the case for multi-stakeholder financing

In their groundbreaking Health Affairs article, Len Nichols and Lauren Taylor assert that SDoH investments should be seen as a “public good” which benefits multiple entities simultaneously and provides value which cannot be limited only to those parties who pay for them. They portray a hypothetical non-emergency transportation program developed as a public good and demonstrate that all stakeholders (Medicaid, Medicare, private insurers, providers and uninsured people) would benefit from such a program. Their detailed analysis depicts hypothetical positive returns on investment (ROI) to all stakeholders who would participate.

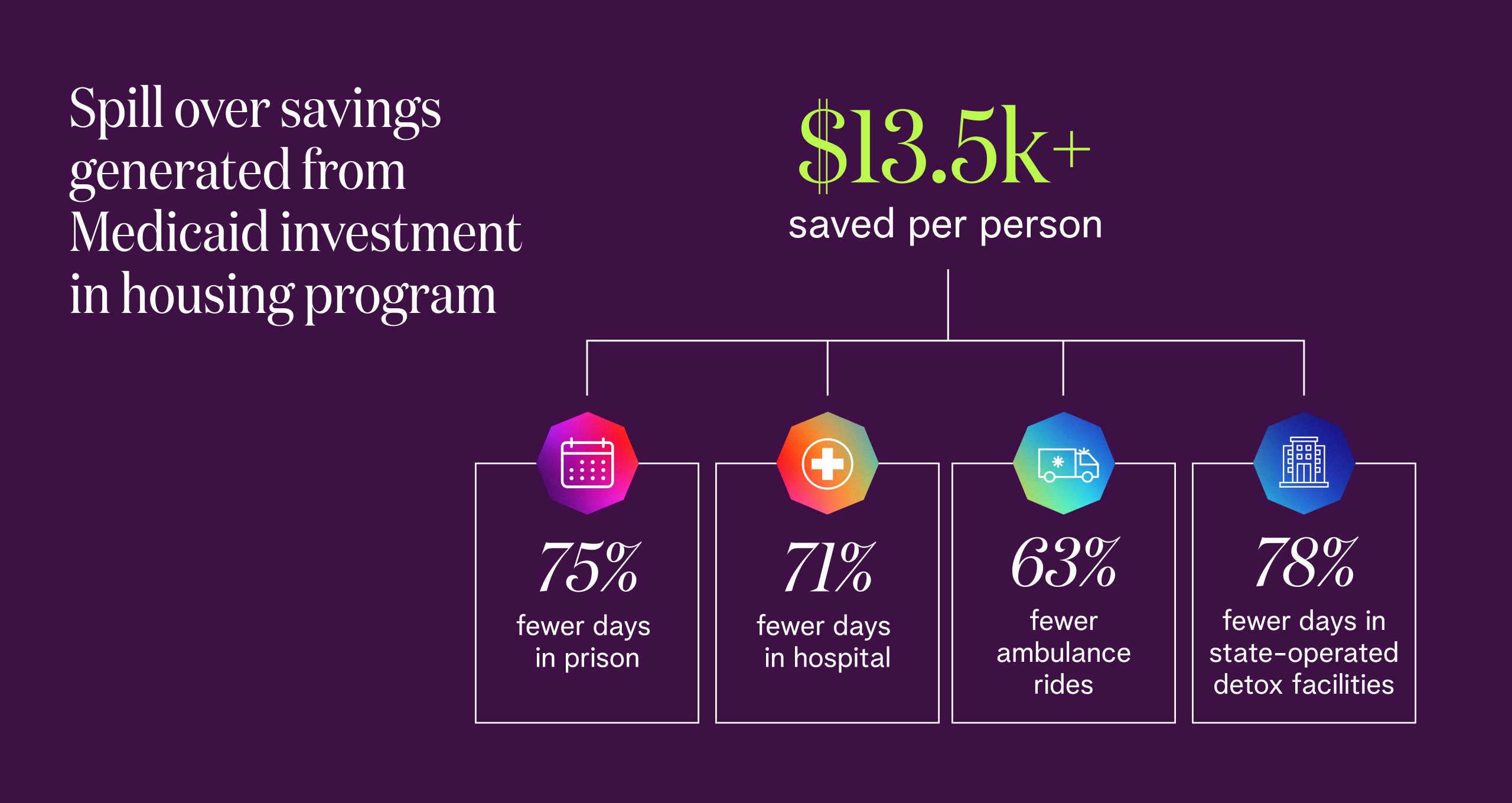

My own experience supports their findings. When I served as COO of the Massachusetts Medicaid program, I made Medicaid data available to the Massachusetts Housing and Shelter Alliance to support analysis of their Home and Healthy for Good initiative, a housing-first program for homeless Medicaid members. The program’s 2017 progress report tells the tale: even with the Commonwealth bearing 100% of the housing costs, the program achieved savings of more than $13,500 per person. These savings were generated from many sources, including reduced Medicaid beneficiary expenditures. But a great deal of the savings came from spillover effects resulting from Medicaid’s investment, including declines in:

Average days in hospital (from 3.5 to less than 1)

Days in state-operated detox facilities (from 4.5 to less than 1)

Average days in prison (from about 1.2 to about 0.3)

Average ambulance rides (from about 2.7 to less than 1).

In other words, the prison system, local ambulance services and state-operated detox facilities all benefited from Medicaid investments. Seeing these results, I think we should take the next logical step in the Nichols and Taylor research and treat Medicaid itself as a public good.

These two examples of how a multi-stakeholder financing model could be a good thing for Medicaid and have positive spillover effects for our communities highlight the principal challenge of the current model: it works against long-term thinking. Most people on Medicaid, about 72%, are enrolled in managed care organizations (MCO). Managed care companies operate on slim margins and must make clear-eyed financial decisions about where to invest resources. Investments in longer-term interventions (such as longitudinal care, seamless handoffs from one plan to another, and SDoH) are hampered by the fact that Medicaid members churn on and off the program frequently. KFF reports churn rates range from 5% to 15%. Practically speaking, this means lost capitation payments for MCOs and a lack of visibility or influence over which plan a member re-enrolls in when they re-establish eligibility. As a result, there is little incentive to invest in long-term solutions that may not provide ROI to the plans that invest in them. In other words, perfect conditions for the multi-stakeholder funding model hypothesized by Nichols and Taylor.

Other experts concur. “Medicaid promotes efficient uses of resources so all citizens can benefit from a smoother operating healthcare system,” Buchert says. “It makes sense to evolve the funding model in a way that includes appropriate investment from all stakeholders who benefit from the program.”

Adds Nikita Singareddy, Co-Founder and CEO of Fortuna Health, a startup aimed at digitizing and streamlining the Medicaid experience, “If our shared goal is to help Medicaid members achieve and maintain good health, then we need all stakeholders rowing in the same direction. That’s why I’m excited about exploring multi-stakeholder financing models, as they have the potential to attract a wider range of investors in the Medicaid program, calibrating the level of investment to the benefits obtained by each stakeholder.

“With 58 years of Medicaid experience behind us, I think we now know enough to find a way for the financing model to align with Medicaid’s far-reaching impact.”

ABOUT FORTUNA: Clear, accessible health information is a social determinant of health. Fortuna brings this approach to its simple, consumer-first platform for accessing and navigating Medicaid. Everyone benefits when Medicaid enrollees have the tools they need to enroll and renew their coverage: beneficiaries face fewer care gaps, providers face less uncompensated care, and MCOs retain members. This helps MCOs and other Medicaid stakeholders make better long-term care investments.

Let’s move forward with courage

It took tremendous courage for LBJ to address Congress with a plan for Medicare and Medicaid in 1965. By encouraging development of a multi-stakeholder funding model, can we tap into our personal level of bravery and create a modern Medicaid system with the power to change even more lives? This idea may sound simple on paper but would require a great deal of state and federal coordination and alignment--if you are a Medicaid official, what are your thoughts on the practical realities of moving in this direction? Where should we start? From the health plan and provider perspectives, what do you see as the benefits and challenges of transitioning to a multi-stakeholder financing model? Can we achieve consensus on how to move forward? Last but not least, if you are or were a Medicaid beneficiary, what are your views on exploring this model?

Phil is a Health and Human Services leader with more than 25 years experience in government, consulting and nonprofits. He earned an MA in Urban and Environmental policy at Tufts and then spent 13 years in Massachusetts state government working in affordable housing and Medicaid. He served as Medicaid COO during the Massachusetts healthcare reform effort and then transitioned to Accenture where he built the insurance exchange practice and a portfolio spanning Medicaid Managed Care and Social Determinants of Health. Before joining Redesign, Phil served as Vice President for Strategic Accounts at Unite Us, the industry leading SDOH referral platform. Phil earned his BA in Political Science at Duke and lives in Charlotte, NC with his wife Denise, where he has invested time over the past eight years as a board leader.

![No alternate text]() Redesign HealthDemystifying Healthcare Innovation: 4 Lessons on Driving Meaningful Change

Redesign HealthDemystifying Healthcare Innovation: 4 Lessons on Driving Meaningful ChangeInnovation is a frequently used buzzword in healthcare. Despite its widespread usage within our industry, achieving tangible value and impactful outcomes often proves challenging.

April 16, 2024

![No alternate text]() Healthcare TrendsRedesign Health2024 Health Trends: 4 Experts Discuss Key Innovation Priorities

Healthcare TrendsRedesign Health2024 Health Trends: 4 Experts Discuss Key Innovation PrioritiesTo uncover the most pressing healthcare issues—and possible solutions—on the horizon for 2024, our team polled four influential industry thought leaders and Executive Advisory Board members at Redesign Health.

January 10, 2024

![No alternate text]() MedicaidModernizing Medicaid with a Multi-Stakeholder Financing Model

MedicaidModernizing Medicaid with a Multi-Stakeholder Financing ModelDiscover how a multi-stakeholder financing model could overcome some of Medicaid’s obstacles, dramatically improving health and quality of life outcomes for Medicaid recipients while generating savings across government programs.

November 15, 2023

![No alternate text]() Chronic CareRedesign HealthWraparound Care: The Next Frontier in Chronic Care Management

Chronic CareRedesign HealthWraparound Care: The Next Frontier in Chronic Care ManagementExploring tech-infused strategies to manage chronic conditions

September 05, 2023

![No alternate text]() ADVISORSRedesign HealthRedesign Health Advise: Leveraging Experts and Insights to Expand Impact

ADVISORSRedesign HealthRedesign Health Advise: Leveraging Experts and Insights to Expand ImpactThe Redesign Health Advise program connects our team and founders with a deep bench of experts from across the healthcare industry.

June 29, 2023

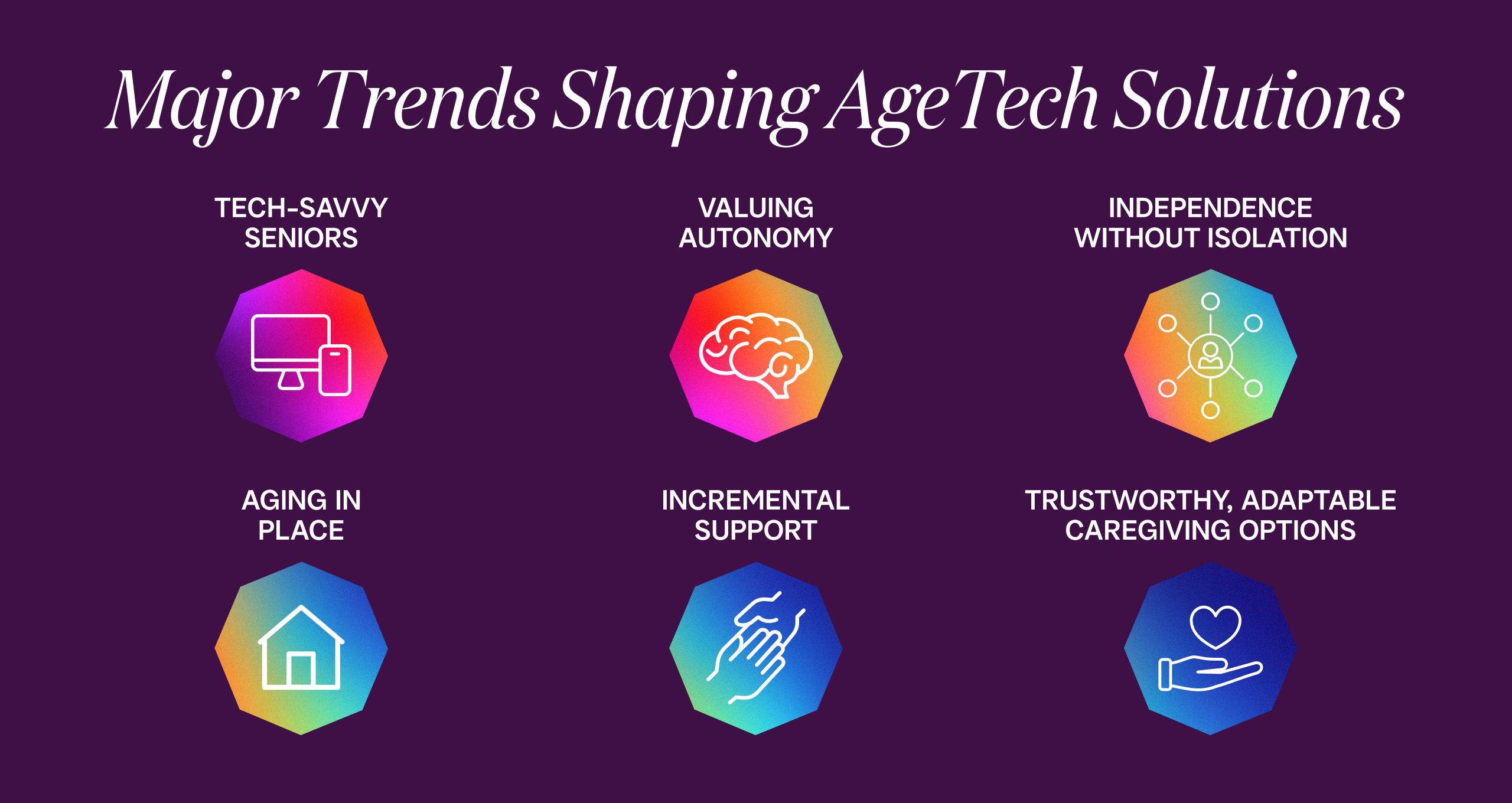

![No alternate text]() Senior HealthRedesign HealthInvesting in AgeTech: Serving the Growing Senior Health Market

Senior HealthRedesign HealthInvesting in AgeTech: Serving the Growing Senior Health MarketProviding targeted tech solutions for aging adults

June 14, 2023

![No alternate text]() Shifting Sites of Patient Care: Driving Value in Alternative Settings

Shifting Sites of Patient Care: Driving Value in Alternative SettingsRight care, right setting: Unlocking value in alternative sites of care

April 27, 2023

![No alternate text]() Value-Based CareThe Evolution of Value-Based Care: Exploring Challenges and Opportunities in Adoption

Value-Based CareThe Evolution of Value-Based Care: Exploring Challenges and Opportunities in AdoptionRedesign Health Venture Chair Missy Krasner recently hosted a roundtable discussion with leaders in the Value-Based Care Industry to explore how the adoption of value-based care is unfolding--and what to expect in the coming years.

February 15, 2023

![No alternate text]() James QuarlesThe Kids Aren’t Alright: Addressing the Adolescent Mental Health Crisis With Accessible, High Quality, Evidence-Based Practice

James QuarlesThe Kids Aren’t Alright: Addressing the Adolescent Mental Health Crisis With Accessible, High Quality, Evidence-Based PracticeResearch shows that mental health disorders have surpassed physical conditions as the most common causes of impairments and limitations in children. Suicide was the second-leading cause of death among 10 to 14 year-olds in 2020.

February 15, 2023

![No alternate text]() PartnershipsRedesign HealthPartnering with Leading Health Systems to Drive Change and Improve Outcomes

PartnershipsRedesign HealthPartnering with Leading Health Systems to Drive Change and Improve OutcomesAt Redesign Health, we firmly believe the US healthcare system desperately needs innovation to address our lagging health outcomes, sky-high costs and uneven access to care.

February 09, 2023

![No alternate text]() Platform, Company CreationBehind the Curtain: Redesign Health's Company Creation Process

Platform, Company CreationBehind the Curtain: Redesign Health's Company Creation ProcessIt's easy to say healthcare is broken. It's much harder to fix it. At Redesign Health, we’re up for the challenge.

February 01, 2023

![No alternate text]() Healthcare TrendsHealthcare’s Biggest Trends in 2023: Industry Forecast from Redesign Health

Healthcare TrendsHealthcare’s Biggest Trends in 2023: Industry Forecast from Redesign HealthPowering healthcare innovation at scale is the heart of our work at Redesign Health. With 2023 on the horizon, we surveyed our cross-functional team of industry leaders for their forecast for 2023’s biggest trends in healthcare.

December 15, 2022

![No alternate text]() Insights from the Redesign Health Ecosystem: Improving Healthcare for Older Adults

Insights from the Redesign Health Ecosystem: Improving Healthcare for Older AdultsRedesign Health Venture Chair Missy Krasner recently hosted a roundtable discussion with leaders from three of our Operating Companies to explore the state of older adult healthcare in the U.S. and how their teams are facilitating healthier aging.

October 21, 2022

![No alternate text]() ResearchRedesign HealthStuck in the Middle: Healthcare Solutions for Older Adults Shouldn’t Be One Size Fits All. Here's Why.

ResearchRedesign HealthStuck in the Middle: Healthcare Solutions for Older Adults Shouldn’t Be One Size Fits All. Here's Why.There will be more older adults than children in America by 2035. We are not ready. A one-size-fits-all approach to older adult healthcare simply won’t be able to comprehensively support the needs of so many aging people.

October 05, 2022

![No alternate text]() Company CultureRedesigning Company Culture

Company CultureRedesigning Company CultureWe have big ambitions at Redesign Health: to make humanity healthier and to redesign healthcare for everyone. We strive to do things differently here, and building our company culture is no exception.

July 18, 2022